Marbella Real Estate Market Report 2018

In an era where we’re ‘back to business as usual’, the main message is one of sustainable growth and continuity in the year ahead, but also a reminder to keep a sharper lookout for potential spoilers than the industry did in the years leading up to 2008.

Every year we take time out to take stock of the market; looking back, at the present and forward—the goal being not so much to describe the current situation but to see if there are any important trends or signals that can help us plan for the near future. Having sailed the ship through stormy weather we now find ourselves in calmer waters on a local, national as well as global level. Geopolitics aside, the world seems to be slowly gaining traction and economic growth forecasts are cautiously being raised for the euro zone as well as other parts of the world, though warnings about public, corporate and private levels of debt, as well as the fragility of the credit-based international financial system, remain unanswered.

Many say the core issues leading up to the events of 2008-2009 have not really been addressed. Banks are steadier and the financial sector is ever more tightly controlled but government debt remains a true worry, as do low levels of corporate investment and productivity growth, particularly in Europe – where it is related to a high tax burden – and too much dependence on consumer growth. The latter is fuelled by credit and low interest rates that make some feel unrealistically rich, drive prices up and feed spenders while punishing savers and investors. It worked as part of financial repression in the wake of the sovereign debt crisis, but other than providing cheap capital injections for the larger corporations hasn’t done much to stimulate growth in real terms.

2017 in summary

2017 confirmed the trend of moving ‘out of crisis’ that was started some years ago. As one of the countries leading the euro zone recovery, Spain is posting healthy economic growth rates of between 2,5% and 3%, with unemployment dropping steadily, investment and consumer levels rising strongly and confidence at its highest level in years. The banking and property sectors are similarly in far better health than a relatively short time ago, and here the revival of domestic demand is adding to strong international demand (for big city and coastal properties) in revitalising the construction sector. The tourism boom is further boosting the economy and the balance of payments is positive, so if ever there was a time to reduce the tax burden – particularly on grassroots and mid-sized enterprises – it would be now.

Locally, the picture is even more positive, with tourism aglow and an international homebuyer’s market creating solid growth as shown in home sales, construction starts and property values. For DM Properties it was the wake- up year for the market, with sales strongly higher than 2016, the year when Brexit had its main impact. There was an upswing also in interest among Scandinavian, Dutch, Belgian and French buyers, and the most popular properties were in the mid-range between just under €1 million and just over €3 million, though new- build apartments from €350.000 in the Estepona and Benahavis areas were also popular, and there has of late been a noticeable revival in the luxury market above €4 million.

Property sales from 2004-2017 in Marbella, Benahavís and Estepona

| Year | Benahavis | Estepona | Marbella | Total |

| 2004 | 353 | 882 | 4.779 | 6.014 |

| 2005 | 412 | 2.244 | 4.047 | 6.703 |

| 2006 | 650 | 1.788 | 4.432 | 6.870 |

| 2007 | 633 | 2.581 | 3.568 | 6.782 |

| 2008 | 438 | 1.721 | 2.116 | 4.275 |

| 2009 | 559 | 1.086 | 2.199 | 3.844 |

| 2010 | 422 | 1.154 | 2.389 | 3.965 |

| 2011 | 311 | 1.248 | 2.259 | 3.818 |

| 2012 | 593 | 1.490 | 2.519 | 4.602 |

| 2013 | 532 | 1.669 | 3.106 | 4.807 |

| 2014 | 708 | 2.109 | 3.982 | 6.799 |

| 2015 | 743 | 2.054 | 4.435 | 7.232 |

| 2016 | 625 | 2.118 | 4.003 | 6.746 |

| 2017 | 499 | 2.677 | 4.279 | 7.455 |

| Source: Ministry of Public Works | ||||

Property transactions during 2017 in the ‘Golden Triangle’ of Marbella, Benahavis and Estepona show confirmation that the market is at the highest point in well over a decade, with sales in Benahavis moderate, those in Marbella consistently high and Estepona accounting for much of the growth. The figures from the Ministerio de Fomento (Ministry of Public Works) are accompanied by a national breakdown of foreign property buyers in all of Spain in 2017, which saw the British top the list with 15,01% of sales, in spite of Brexit. They were followed by the French and the Germans (see table quoting the Colegio de Registradores), with 8,64% and 7,77% respectively.

| Ranking of foreign nationalities buying spanish property (nationwide) | |||

| Percentage shows share of the total foreign buyers for each year | |||

| 2015 | 2016 | 2017 | |

| 1 | UK - 21,34% | UK - 19% | UK - 15,01% |

| 2 | France - 8,72% | France - 8,05% | France - 8,64% |

| 3 | Germany - 7,33% | Germany - 7,69% | Germany - 7,77% |

| 4 | Belgium - 6,26% | Sweden - 6,72% | Belgium - 6,39% |

| 5 | Sweden - 5,89% | Belgium - 6,03% | Sweden - 6,38% |

| Source: Colegio de Registradores de Propiedad | |||

The good news is that this is not (yet) a seller’s market, that Marbella’s PGOU issues have probably avoided over-building and a price bubble there, that growth is now more spread out, and that sales and rising home prices are at levels that can be sustained for some years to come – especially given keen interest from overseas buyers. Brexit remains an issue, but the more sophisticated British buyers especially seem hardly affected and the British remain the largest single group amid a very highly diversified client base.

Market trends

The latest growth cycle, which can be said to have begun as early as 2012-2013, was characterised by a significant shift in homebuyer tastes and preferences that kicked off a ‘return’ to white-toned modern architecture. Combined with great advances in construction techniques, new building materials and the proliferation of technologies that would not so long ago have seemed pretty futuristic, this move towards contemporary, open-plan properties featuring the latest home automation systems has manifested itself as the main trend affecting the real estate market on the Costa del Sol these past years.

In the beginning there was a marked shortage of new stock of this kind due to several years of building inactivity – a hiatus that marks a dividing line between two distinct product eras – so the first pioneering investors and developers were well rewarded as modern homes were snapped up eagerly. Since then, many foreign investment funds are involved in new property development along the coast. With significant numbers of new projects currently launched, under construction and already delivered to the market, supply (of new-build homes) is beginning to catch up. For those with a long memory it signals both that we’re in a healthy growth phase and that this is a warning signal.

| Top ten nationalities searching for a property in Marbella in 2017 |

| 1. United Kingdom |

| 2. Spain |

| 3. France |

| 4.Germany |

| 5. Belgium |

| 6. Russian Federation |

| 7. Unated States of America |

| 8. Sweden |

| 9. Switzerland |

| 10. Norway |

| Source: DMproperties.com |

If compared to the previous up-cycle (read: property boom of the 2000s), it places us roughly in 2002, and while this was a time of boom it also proved to be a highpoint not long after which intrinsic demand for Costa del Sol properties was surpassed by a production machine in overdrive.

Reversing the demand-supply mechanism

In a perfect world supply follows demand, but in reality there is inertia, particularly when you’re talking about big-scale projects like property developments. Large sums are involved and years pass between the decision to invest and the final delivery (of product and return), so with the benefit of hindsight to boot we should watch for signs of overproduction – lest we fall into the same trap of inverted dynamics where the output of ramped- up construction has to be flogged to a market with eyes bigger than its stomach. After 2004 intrinsic demand had begun to be sated yet building and sales continued unabated, driven now by inflated property prices that turned Marbella homes into speculative pawns in what eventually became an investment bubble.

Source: Colegio de Registradores de Propiedad

| Percentage of property purchases by foreign buyers in 2017 | |||

| 2015 | 2016 | 2017 | |

| Spain | 13,18% | 13,25% | 13,11% |

| Andalucía | 15,40% | 15,06% | 13,84% |

| Málaga Province | 34,14% | 33,92% | 29,67% |

| Percentages of foreign buyers of the total sales in each area. The total of 464.223 property purchases in Spain in 2017 (highest figure since 2008), represents a 14,98% increase compared to 2016. Sales in Andalucía totalled 88.657 (up by 12,54%) and in Málaga 30.300 (up by 14,62%). | |||

The present conditions are somewhat different – we now no longer live in the era of easy credit, but also haven’t become immune to market bubbles, so in order to avoid it happening again investors and industry pundits should keep a keen eye out for the first signs of oversupply. Overzealous production is never a good thing, but it makes particularly little sense in a luxury market such as that of Marbella. This is as true of real estate as it is of tourism, so this region should jealously guard its five-star rating and focus on quality, not quantity. On a positive note, the large-scale apartment complexes that were being built by 2002 are not (yet) visible, with the largest contemporary projects seldom surpassing 200 units, though some mega-projects have been proposed but none yet realised.

Product development

The modern villas and apartments featuring sleek white lines and open, minimalist interiors full of high-tech gadgetry completed the process by which the Costa del Sol’s property offering has caught up with that in the major centres of the world. Gone are the days when most buyers were not as demanding of the latest comforts as they are now. By and large, the properties on these shores are now sufficiently cutting edge, though what was deemed extremely novel and desirable a mere five years ago is beginning to feel somewhat repetitive. We must guard against an onslaught of unvaried, straight- angled monotony or the market will begin to grow tired of it.

It seems that, from investors and property developers to architects, real estate agents and indeed homebuyers themselves, the message is getting through and diversification is taking hold. A wider palate of materials and styles is adding character to the ‘white boxes’ some had started dubbing modern houses, while more inventive work is also done with layouts, interior styles and landscaping. The new era has also seen a growing diversity of property types, away from the near-total predominance of (two-bedroom) apartments and large villas to now also include larger apartments, with three and also four bedrooms, designed for year-round living, smaller villas and properties such as luxury modern townhouses and semi-detached villas that bridge a gap in the €500.000 to €800.000 segment.

New versus Resale

Where has all this new/modern development left the resales market? With so much of the demand focused on a new generation of properties that really does represent a watershed in housing not only in terms of form but also in content, villas and apartments from before the crisis have suddenly aged rather quickly. Though much of the attention is focused upon newly built properties, resale homes in sought-after locations continue to sell well, and more are expected to do so as time passes and the initial sense of architectural novelty wears off a little.

A large proportion of people looking at resale properties will want to restyle, renovate and at the very least modernise them, but this costs time, money and effort, and that should be reflected in the price. And herein lies the problem, for quite apart from spawning a renovation/ investment industry that upgrades old houses in good locations, resale properties tend to be overpriced.

Sensing that the market is in better health, many a vendor is setting his or her asking price too high, and with the subjectiveness inherent in being a proud homeowner they are not realising that this is largely a dual market right now in which – apart from older properties in locations with scarce building land – new-builds command the highest prices. The latter is especially true when you look past the price label and calculate cost per square metre – where new homes are quite a bit dearer than existing ones – but at least in nominal terms they appear very reasonably priced in comparison with resales. It is also a dual market in the sense that most new-build activity is concentrated in Benahavís, Estepona and Ojén, while Marbella continues to have a strong market dominated by resale properties.

Planning and upcoming areas

You might think to yourself ‘what have urban planning and up-and-coming residential areas got in common?’ but Marbella’s problems in finding a workable directive to guide new development have pushed much of the activity towards Benahavís, Estepona, Mijas and Ojén. The natural tendency in this area is centripetal, a process by which most investment and development has a way of being concentrated in Marbella, but the inertia caused by slow and arduous processing of planning permission applications has produced an opposite effect – a centrifugal shift to the outward lying areas.

In a way this is good, because it has allowed more scope for future growth in Marbella and prevented a real estate bubble from occurring in land and property prices here that would have resulted from the concentration of development within its municipal boundaries. The outward movement has absorbed much of the stresses, spread growth more evenly and also dampened the impact of price rises. This not only makes growth more sustainable but also allows new real estate ‘hotspots’ to develop, and they are great for investors and homeowners alike. So, while classic addresses such as the Golden Mile, Nueva Andalucía and La Zagaleta remain timeless gems they are now joined by increasingly in-vogue areas such as La Alquería, Atalaya, El Paraíso and the New Golden Mile.

As a result, there is a good mix of new developments on the market, mostly by large Spanish promoters backed by investment funds, many of which are American, though there are also private developers of smaller gated villas.

PROS

- Strong demand from a highly diversified market.

- Growth of property sales and (to a lesser extent) prices is at sustainable levels.

- Costa del Sol property prices are generally still attractive to many across Europe and beyond.

- Historically low interest rates.

- High holiday let occupation rates and good long-term rental returns for property owners.

- Security and quality of life.

- Good and yet improving connectivity.

- A good selection of properties and areas to choose from.

- Growth well spread out geographically.

CONS

- Land prices are growing rapidly and resale properties are arguably overpriced.

- Interest rates could begin to rise (though slowly).

- Danger of buyer fatigue.

- Supply is catching up with demand – danger of oversupply if it surpasses it.

- Possibility of a drop in tourist visits as other destinations such as Tunisia, Turkey and Egypt begin to recover.

Client profile

Most buyers are couples or families, above all from late thirties up to mid-sixties, and the majority are lifestyle or end-user buyers, with a smaller number buying purely for investment.

Price trends

The offers made by buyers are not as aggressive as before. In many cases they come in quite close to the asking price and eventual discounts are within the ten per cent range. Buyers in search of deals have to face a situation where properties are selling faster and closer to the asking price than before.

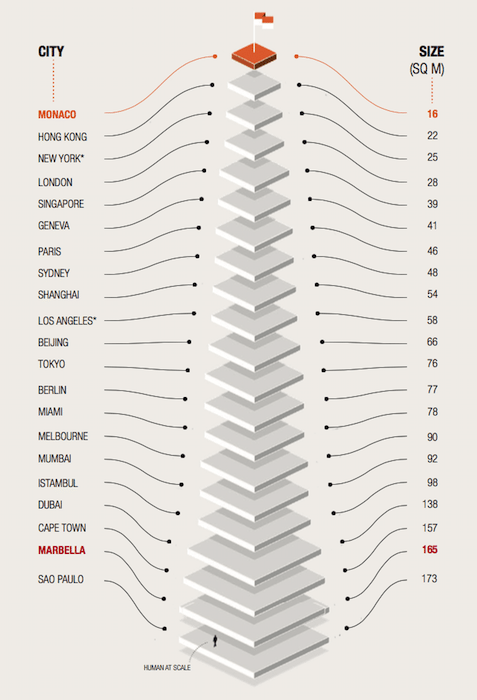

Looking at Knight Frank’s 2018 Wealth Report, however, Marbella still offers great value in spite of rising prices. In Monaco, which continues to top the international price list, $1 million will buy you just 16 m2, with Hong Kong, New York, London, Singapore, Geneva and Paris following and taking it up to 46 m2 for a $1 million spend. Marbella doesn’t make the top-20 in this mostly densely built-up big city list, so you get more than ten times as much square meterage for your money as in Monte Carlo. Given that the real estate itself is generally of a far superior quality, apart from being a tax haven the principality has far less to offer in intrinsic terms.

Consumer trends

Most clients have similar requests; sea views, walking distance to amenities, south or south-west orientation, privacy and sea views. Gated communities are also a popular request but not a necessity, and there is greater acceptance of new areas than before. The most popular properties are Nueva Andalucía apartments from €150.000 to just under €1 million and villas from the latter price up to €2,5-€3 million. The sweet spot is apartments of around €500.000 in prime spots close to services. For villas it’s for three-bed and up properties of up to €2 million in prestigious areas close to beaches and amenities. Gated communities and well-established areas are an important extra. In the segment above €3 million the prestige of the area is important along with commanding views.

Product trends

People are still looking for modern styled apartments but in the villa sector we are starting to get requests for a modern style with character. Many of the ‘box’ styled villas will become dated in the next few years and already buyers are beginning to veer away from them and are requesting more ‘Mediterranean’ touches. In response, architects are starting to move away from white boxes with glass façades and apply warmer materials such as wood, stone and also more greenery, with an increase in shaded porches and covered areas, though still looking to maximise natural light indoors. The trend is away from too starkly modern, and while very classical or idiosyncratic homes are not in vogue, there is increasing demand for properties that are easy to modernise.

Looking to 2018 and beyond

The new year has continued the momentum of 2017, which gathered pace in the second half of the year, and all the indicators are pointing at another year of good, solid growth at levels that are not overheated but sustainable. If anything is headed that way it’s land prices, which have risen quite a bit faster than the selling price of the end product, thus tightening the margins of developers and investors. The newly emerging ‘hotspot’ areas offer some scope for greater gains, though here competition for land is also fierce and the selling price is connected to the land cost when compared to Marbella. The ‘luxury’ brand evolution of such areas is still in full development, and is best served by the consolidation of areas marked by quality developments and urban infrastructure.

For the time being, however, there is no imminent fear of a bubble market, and while the stock markets have received a jolt their impact is expected to be limited as this is more a price correction than a reflection of major macroeconomic trends or corporate profitability. Corporate debt, on the other hand, is a concern, and some say this, together with the impact of Brexit, could cause the onset of the next slowdown around 2020- 2021, though it would be a mere cyclical recession and far milder than the great one we suffered through between approximately 2008 and 2013. For now, the forecast is sunny, but ‘beware the ides of March’, for now – in what we estimate to be the late summer of our up-cycle – is the time to learn from the past and begin looking out for factors that could spoil the party.

Relative Values

How many square metres of prime property U$$1m buys across the world.

*New developments only. All data Q4 2017 based on exchange rate on 31 Dec 2017. For Marbella, average price of new prime property (not frontline beach) $6.000/m2, while prices for the exclusive Uno at El Ancón Beach on the Golden Mile has all units pre-reserved and average around $16.000-$18.000

The latter includes concern among agents and promoters about the large numbers of properties under construction right now. If this trend continues there is a real danger that supply will surpass demand, just as it did a dozen years ago. Already, at the lower end of the market, many of the buyers are investors not end- users, and that’s exactly what happened then too. It would signal that we’d be entering the speculative phase of the cycle and that’s a good time to start applying the brakes. “Countering this is the belief that the market still has several years of good growth ahead of it and can bank on an ever-improving infrastructure and level of professional services, growing connectivity through new flight routes linking the region to different parts of the world, and a burgeoning cultural and gastronomic offer here and in nearby Málaga – not to mention the enduring appeal that sets Marbella apart and makes it an evergreen luxury destination,” says Diana Morales, Founding partner of Diana Morales Properties | Knight Frank.

Download Marbella Real Estate Market Report 2018

Contributors: The DM Properties team

Written by Michel Cruz