Latest world economic news for 2024

As we’re now well and truly into the new year, a clearer picture is beginning to form about the geopolitical situation, the economy and asset markets ranging from Bitcoin and the stock exchange to property and gold.

The big wide world with all its problems and complications sometimes seems far removed from the sunny pleasures of the Costa del Sol. Here, and specifically int he area known as the 'Golden Triangle', 2021, 2022 and 2023 were bumper years for the local economy, with property transactions and tourist numbers hitting new highs, and prices rising solidly across the board. The region welcomed 14 million tourists in 2023, a new record, and it could be bettered in 2024.

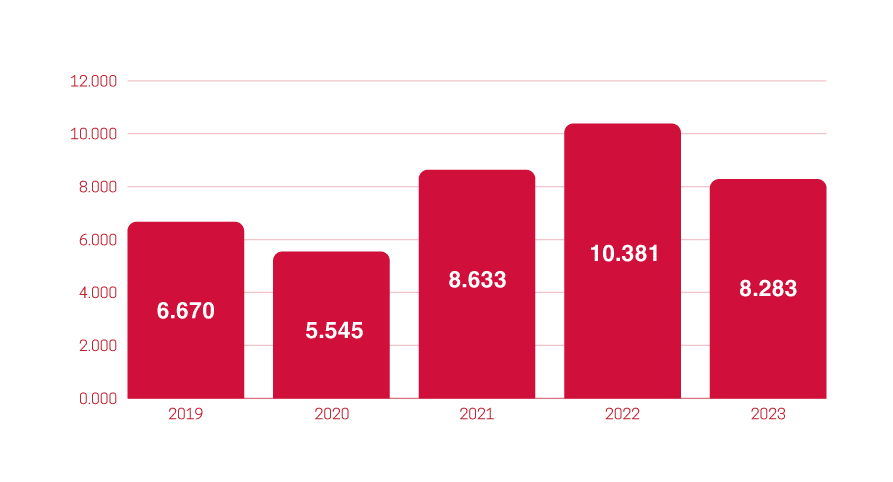

Property Sales in the 'Golden Triangle', Costa del Sol

However, as the year drew to an end, there were worrying signs of possible challenges ahead. All the uncertainty abroad made us cast a wary eye at wars in Ukraine and Gaza in a world that feels increasingly drawn into differing camps again, with hostility bubbling below the surface between America, Russia, China and others.

On the economic front, Bitcoin had slumped, inflation was brought largely to heel but interest rates were still uncomfortably high, and economic slowdowns seemed to herald the beginning of a global recession in 2024. And yet, the year got going and little changed. Inflation stayed put, interest rates were slowly starting to come down, and while some countries began to experience light recession, others, like the USA, defied the doomsayers and continued to grow.

What lies ahead

Almost one quarter into the year, we can say that while things have not significantly improved, they have also not become worse. In fact, Bitcoin rallied to an all-time high of over $65.000, oil and gold are performing solidly and the markets in general have been booming. On the Costa del Sol, tourist visits are expected to remain high this year, and it has indeed been an unseasonably busy winter - and the property market has continued to do well too.

Yet, what lies ahead? There are signs that the US economy is beginning to slow a little, prompting the Fed (Federal Reserve) to predict four not six interest rate drops this year, a slightly more cautious path than that chosen by the BoE but about equal to the ECB’s. Rate cuts paired with slowing inflation should soften the load on the economy and consumer alike, and this could spur things on again, though it is felt that not even AI – the new poster boy – can recreate the booming stock markets of recent times.

If venture capital investment in new tech start-ups peaked in 2022, it is now largely replaced by interest in AI specifically, yet we don’t know exactly how that will affect the greater economy and society in the coming years. These are changing times, and this always seems to actually be a bonus for a safe and lifestyle-oriented destination such as Marbella and surroundings. We saw this in the aftermath of the pandemic and the start of the Russian-Ukrainian war, and though the local property market has so far trended a little below the 2023 mark, it remains remarkably buoyant.

Wealth shifts

As the 2024 Knight Frank Wealth Report indicates, there has been a continued shift of wealth downwards in age, with the epicentre dropping from the upper 50s range to the upper 40s range. Cities continue to do well as hubs of wealth concentration, but we are also seeing that traditional ones such as London, New York and Sydney are losing their top spots to the likes of especially Dubai, which blends the Marbella lifestyle with a big-city environment. That said, money has also been flowing to safe lifestyle destinations, and here Dubai struggles to provide a year-round option for those who can choose where they spend their time, benefiting coastal beauty spots and in particular Marbella, which was voted the ‘Best European Destination 2024’ by the European Best Destinations organisation. In short, Marbella more than ever is the favourite of European and also Middle Eastern buyers, and now they are increasingly joined by affluent North Americans.

Property price increase in the 'Golden Triangle'

| City | 2022 | 2023 |

| Marbella | 20,2% | 18,6% |

| Benahavis | 9,7% | 7,5% |

| Estepona | 20,3% | 19,3% |

| Source: Registradores and Idealista | ||

This process is now also boosted by the fact that the Málaga region is undergoing something of a tech boom, and while price hikes could become an issue, we have recently seen them begin to stabilise a little. Spain too has seen some turmoil return to the political stage, but the economy powers on nicely, growing 2,5% in 2023 and expected to almost reach 2% this year. Overall, the signals are sufficiently mixed to keep things balanced, and locally the end of the upward momentum has not been reached.

Pia Arrieta, 28 Mar 2024 - Intelligence - News

Related Articles

Is the Marbella property market heading for a bubble?

6 min. read · Pia Arrieta

Knight Frank Global House Price Index, Q4 2024

2 min. read · Pia Arrieta

Welcoming New Leadership at DM Properties.

2 min. read · Pia Arrieta

A global super-prime sales surge, Q4 2024

2 min. read · Pia Arrieta